- Written By Team DWS

- Festivals

- April 07, 2025

The History of National Tax Day: How April 15 Became the Day We All Dread

Each year, as spring blooms and winter's chill fades, millions of Americans experience a collective shiver of dread. April 15th marks the dreaded National Tax Day, a date that evokes feelings of anxiety, frustration, and, for some, a moment of reckoning. But how did this date come to symbolize the burden of taxation? Let’s take a closer look at the history of National Tax Day and how it has evolved into a pivotal event in the American fiscal calendar.

-dws638795874368282354.jpg)

The Origins of Federal Income Tax

To understand National Tax Day, we must first consider the origins of the federal income tax itself. The groundwork was laid in the early 20th century when the 16th Amendment was ratified in 1913. This amendment allowed Congress to impose an income tax without having to distribute it among the states or relying on the U.S. Census for its calculation. By this point, federal government funding primarily relied on tariffs and excise taxes, making it ill-equipped to handle the growing demands of a rapidly industrializing society.

The first income tax returned will be filed this year in 1913, but decades passed before April 15th became the due date for these submissions. Tax returns were originally due on March 1st, giving taxpayers just a month to gather their documents and submit their hard-earned income.

The Shift to April 15th

The switch to April 15th as the official due date for federal income tax returns occurred in 1955. This adjustment aligned the tax deadline with the natural fiscal calendar, as the IRS observed that many taxpayers were still struggling to compile accurate records in February and March, making it an impractical timeline. The government's decision to extend the deadline by over a month allowed for a smoother filing process, which was also crucial in developing the organization we recognize today.

However, even after the deadline was changed, the tax process remained daunting for many. As the complexity of the tax code grew, so too did the anxiety surrounding tax season. By the 1980s and 1990s, as the IRS increasingly enforced compliance and penalties for errors grew more severe, Tax Day transformed from a mere administrative formality into a source of significant stress.

The Cultural Perception of Tax Day

With the logistical realities of tax season firmly in place, Tax Day began to garner cultural significance. Television shows, movies, and advertising campaigns began to capitalize on the anxiety surrounding this date, reinforcing its status as a day of dread. One commonly referenced cultural touchstone is the animated television special “The Tax Day Parade,” which humorously highlights the follies of tax preparation.

In addition, many comedians and public figures have used Tax Day as a springboard for their routines and commentary, often mocking the convoluted tax code and the “joy” of cramming in last-minute paperwork. As a result, it’s not just an annual deadline; it symbolizes the larger frustrations and complexities of modern life—balancing work, finances, and compliance with an ever-evolving tax system.

The Impact of Technology

However, the advent of technology brought a transformational shift in how Americans approach Tax Day. The rise of tax preparation software such as TurboTax and H&R Block has demystified the process for millions, making it easier to navigate the intricate labyrinth of deductions, credits, and calculations. Moreover, electronic filing has significantly simplified the submission process, allowing individuals to file quickly and efficiently from the comfort of their homes. Despite this convenience, the deadline remains a source of frustration.

Tax Day in a Changing World

In recent years, National Tax Day has witnessed a few notable changes and uncertainties. The COVID-19 pandemic forced the IRS to extend deadlines in both 2020 and 2021, emphasizing how external factors can disrupt this long-standing tradition. This adaptability from the government serves as a reminder that, while Tax Day evokes dread, it is also capable of change and evolution in addressing the needs of the American citizenry.

Moreover, with the growing discourse surrounding wealth inequality and tax reform, Tax Day is ever more central to national conversations about fairness, economic balance, and responsibility. Discussion around changing tax policy—whether to increase rates on the wealthy or introduce new tax credits—continues to shape public opinion.

Conclusion

As April 15th approaches each year, Americans prepare to tackle their tax obligations with a mix of dread and resignation. From its humble beginnings as a post-1913 bureaucratic requirement to a day that looms large in the national consciousness, National Tax Day reflects broader themes of responsibility, complexity, and the evolving relationship between citizens and government. While it may remain a day we all dread, it is also a day that sparks vital discussions about fiscal responsibility and fairness in American society. So, as you gather your W-2s and receipts next April, remember—you’re part of a long tradition of civic duty and financial accountability. Each year, as you navigate the intricacies of the tax system, you're engaging in a crucial process that not only funds government services and infrastructure but also shapes the social contract between you and the state. As such, National Tax Day is not merely a deadline; it serves as a reminder that our contributions, however daunting they may seem, play a vital role in the functioning of society and the promotion of the common good. Embracing this responsibility can lead to greater understanding of our civic duties, informed dialogue about economic policies, and a collective effort to foster a fairer and more equitable system for all.

-dws638795874510310492.jpg)

National Tax Day FAQs: Your Essential Guide to Understanding Tax Day

Here’s a set of frequently asked questions (FAQs) regarding National Tax Day:

1. What is National Tax Day?

National Tax Day is the deadline for individuals to file their federal income tax returns with the Internal Revenue Service (IRS) in the United States. It typically falls on April 15th, unless it coincides with a weekend or holiday.

2. Why is National Tax Day important?

National Tax Day is important because it marks the final date for taxpayers to submit their income tax returns for the previous calendar year. It’s critical for compliance with federal tax laws and affects taxpayer liability, refunds, and potential penalties.

3. What happens if I miss National Tax Day?

If you miss the deadline to file your taxes, you may incur penalties and interest on any taxes owed. It is advisable to file for an extension if you cannot meet the deadline, which allows you additional time to submit your return.

4. Can I file for an extension?

Yes, taxpayers can request an automatic six-month extension by submitting Form 4868. However, this extension only applies to the filing of the return and not the payment of taxes owed. To avoid penalties and interest, you need to pay any estimated taxes by the original National Tax Day deadline.

5. What documents do I need to file my taxes?

Common documents include W-2 forms from employers, 1099 forms for other income, bank statements, receipts for deductions, and any other financial documents that reflect your income and expenses for the tax year.

6. When should I start preparing my taxes?

It’s advisable to start preparing your taxes early, as this gives you ample time to gather all necessary documents, understand your tax situation, and avoid last-minute stress. Many taxpayers begin their preparations as soon as they receive their W-2 forms, typically in late January or early February.

7. What are some common tax deductions I can claim?

Common tax deductions may include mortgage interest, charitable contributions, medical expenses, state and local taxes paid, and student loan interest. However, eligibility for deductions can vary, so it’s important to review IRS guidelines or consult a tax professional.

8. Where can I find help if I have questions about my taxes?

If you have questions about your taxes, you can refer to the IRS website, consult a tax professional or accountant, or visit a local Volunteer Income Tax Assistance (VITA) site for free tax help.

9. Are there penalties for not filing a tax return?

Yes, failing to file a tax return can result in significant penalties, including a failure-to-file penalty that can accrue monthly. Additionally, you may face interest on any unpaid taxes.

10. What is the difference between a tax refund and a tax credit?

A tax refund is the money returned to you by the IRS if you’ve overpaid your taxes throughout the year. A tax credit directly reduces your tax liability, which can lower the amount of tax you owe or increase your refund.

End

National Tax Day is a crucial date in the U.S. tax calendar, serving as a reminder for taxpayers to meet their obligations. Make sure you are aware of your responsibilities and seek assistance when needed to ensure compliance and avoid penalties.

Popular on Blogs

Black Tourmaline: Meaning, Healing Properties, Fascinating Facts, Powerful Attributes, Versatile Uses, and Beyond

September 05, 2023 / BY Team DWS

Black Tourmaline, also known as Schorl, is a highly revered crystal with incredible metaphysical properties. It derives its name from the Dutch word "turamali," meaning "stone with ..

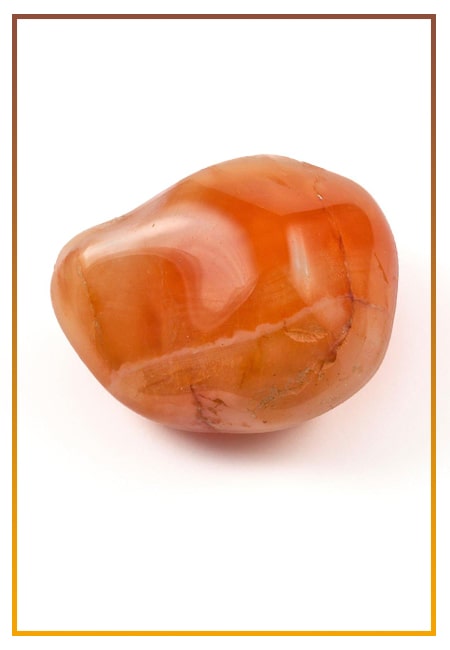

Carnelian Stone: Meaning, Healing Properties, Power, Facts, Color, Uses and More

December 26, 2023 / BY Team DWS

Carnelian is a vibrant and captivating gemstone that holds a plethora of meanings, healing properties, and powers. Its warm and fiery energy makes it a popular choice among crystal ..

Citrine: Exploring its Meaning, Healing Properties, Fascinating Facts, Powers, Versatile Uses, and Much More

November 18, 2023 / BY Team DWS

Citrine, with its warm golden hues, has captured the attention and imagination of people for centuries. This beautiful gemstone, commonly associated with wealth and prosperity, hol ..

Black Onyx: Unveiling the Meaning, Healing Properties, Fascinating Facts, Powerful Attributes, Versatile Uses, and Beyond

July 25, 2023 / BY Team DWS

Black Onyx, a striking gemstone admired for its deep black hue and elegant appearance, has captivated people for centuries. In this comprehensive guide, we will delve into the mean ..

Unveiling the Mysteries of Turquoise Stone: Exploring its Meaning, Healing Properties, Power, Facts, Color, Uses, and More

December 05, 2023 / BY Team DWS

Turquoise, with its captivating blue-green hue, has been adorning jewelry and artifacts for centuries. This striking stone has a rich history, rich symbolism, and a plethora of int ..

The History Behind The Popularity of Red Agate

December 23, 2022 / BY Team DWS

An Agate is a type of magma rock that takes many years till it is washed out naturally into the water. And that is the reason this stone has elements of water. This beautiful stone ..

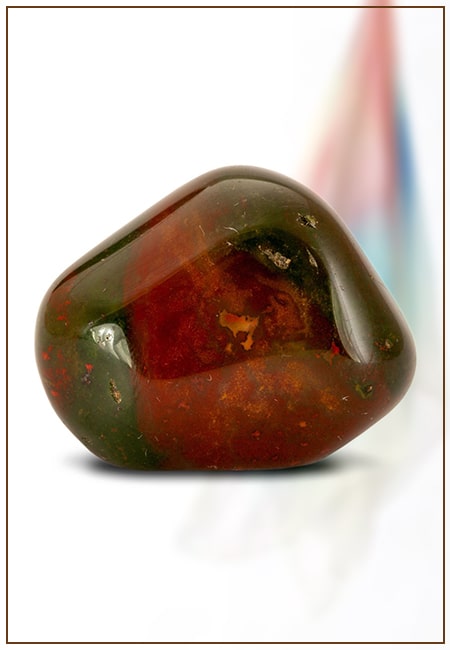

Bloodstone: Unveiling the Meaning, Healing Properties, Facts, Powers, Uses, and More

August 21, 2023 / BY Team DWS

Bloodstone, with its captivating deep green color with specks of red, is a mesmerizing gemstone that has fascinated civilizations for centuries. It possesses unique healing propert ..

Plan a Perfect Valentine's Week with Our Valentine Week List 2025

January 22, 2024 / BY Team DWS

Valentine's Day is undoubtedly the most romantic day of the year, but we believe that one day is just not enough to express your love and make your partner feel special. That's why ..